One of the Democrats’ top talking points about any GOP tax cut plan is that it is designed to reduce taxes for the very wealthy, and is often “paid for” by cuts in federal programs that disproportionately help the poor. Given the complexity of the federal tax code, there are, of course, many ways to hand out money to the oppressed rich people of America. But by far the most visible is a reduction in the “top rate” — the marginal income tax rate on taxable earnings over $418,000 (or $470,00 for couples filing jointly). That top rate is currently 39.6 percent, after a temporary drop to 35 percent during the ten years that the Bush tax cuts were fully in place.

The early blueprint for the Trump tax plan had the top rate dropping back down to 35 percent. But now, according to Axios, there’s talk among tax-writers in the House of leaving it where it is for millionaires, basically to take away that Democratic talking point: “Under their current thinking, people who earn between $418,000 and $999,999 will be in a lower tax bracket. But those earning $1 million or more will not.”

Politico reports chatter that the same tax-writers are even thinking of bumping the top rate up slightly, to 40 percent, to show how tough they are on rich people. But that’s very unlikely, because it would trigger all sorts of conservative trip wires and solemn oaths opposing tax-rate increases on anybody of any sort. The last thing Republicans need right now is to draw the wrath of chief tax commissar of Grover Norquist.

It’s important to understand that even if the top rate remains unchanged, millionaires will still get a tax cut on their first $1 million in earnings; only income above that level would still be taxed at the top rate.

More important, other provisions of the tax-cut bill are sure to shower material benefits on millionaires.

Some will obtain a rich harvest from the proposed deep rate cut for “pass-through” income: business income earned by sole proprietorships or partnerships (e.g., law firms, medical practices, and financial consultancies) that is currently taxed at individual rates.

Others will simply shift compensation from salaries and benefits to lower-taxed capital gains via dividends and equity transactions from corporations, which, under the plan, would be paying sharply lower rates.

And millionaires are virtually the only beneficiaries of the elimination of federal inheritance taxes that will be part of this and every other GOP tax plan.

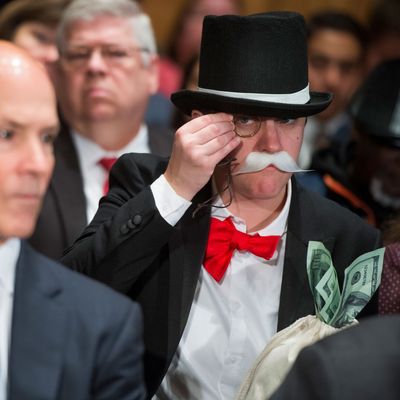

None of these vastly mitigating factors would, of course, be acknowledged in GOP propaganda, including presidential tweets. But if Republicans decide to deploy this fig leaf and boast of their unwillingness to give the very wealthy a tax cut, you can expect Democrats to turn to green-eyeshade experts to analyze the overall distributional effects of the bill in a way that shows Daddy Warbucks is still going to be the big beneficiary. Then it will become a matter of whom you believe. And maybe the real GOP ace-in-the-hole is that its “base” wants to believe Trump & Co. just want to relieve the middle class of some of the burden of supporting the Swamp.